Last week Jeff Burd, publisher of BreakingGround magazine, shared his views on the local economy with the AIA-MBA Joint Committee. Following are highlights from that talk as well as key slides from his explanation of the strengths, weaknesses, opportunities and threats facing the sector in the next one to two years.

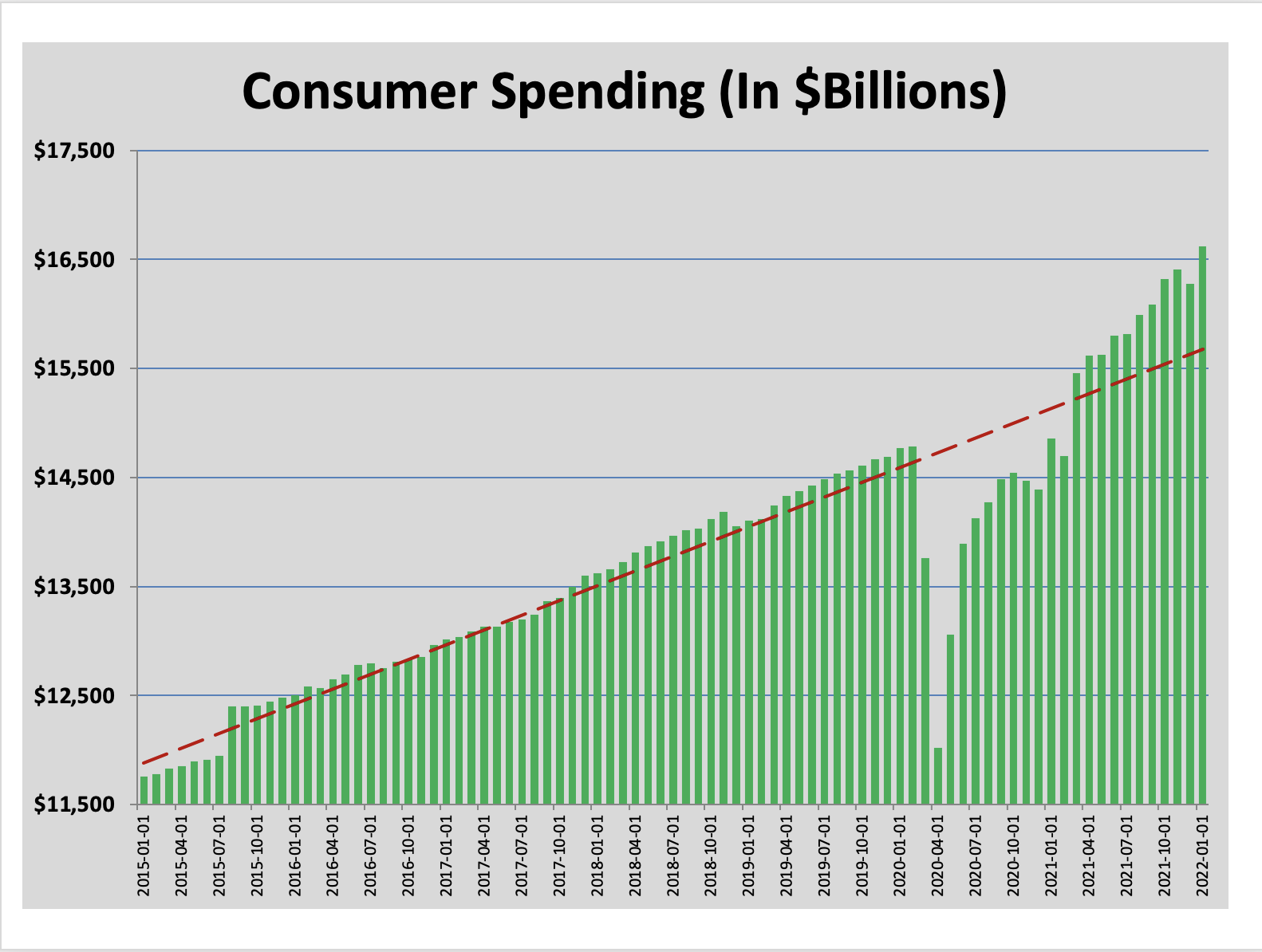

Entering 2022, conditions for the regional construction industry were set for a boom of mega projects and a strong market for all sectors, with the exception of the K-12/public building sector. A robust recovery from the pandemic slowdown was underway, public health conditions were improving enough to see normalization of economic activity, CARES Act/ARP/PPP boosted consumer and business balance sheets, and the drivers of the regional economy were poised to outperform the U.S. economy.

The lingering effects of the pandemic, inflation, and a disrupted supply chain were the main threats to the extended strong construction economy. At the end of the first quarter those threats have grown to the point where it seems likely that contracting and starts will be off by as much as 30% in 2022 compared to 2021.

The lingering effects of the pandemic, inflation, and a disrupted supply chain were the main threats to the extended strong construction economy. At the end of the first quarter those threats have grown to the point where it seems likely that contracting and starts will be off by as much as 30% in 2022 compared to 2021.

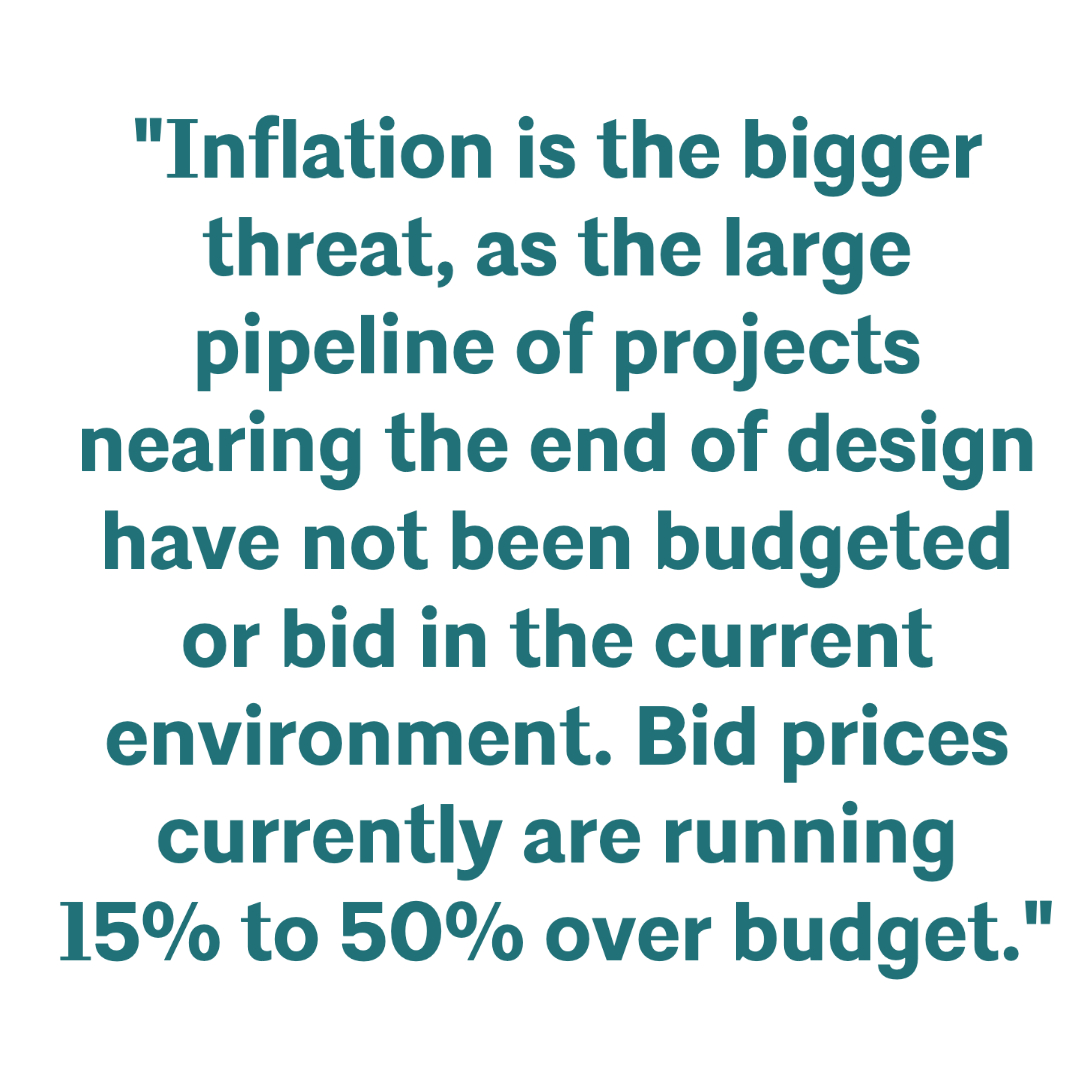

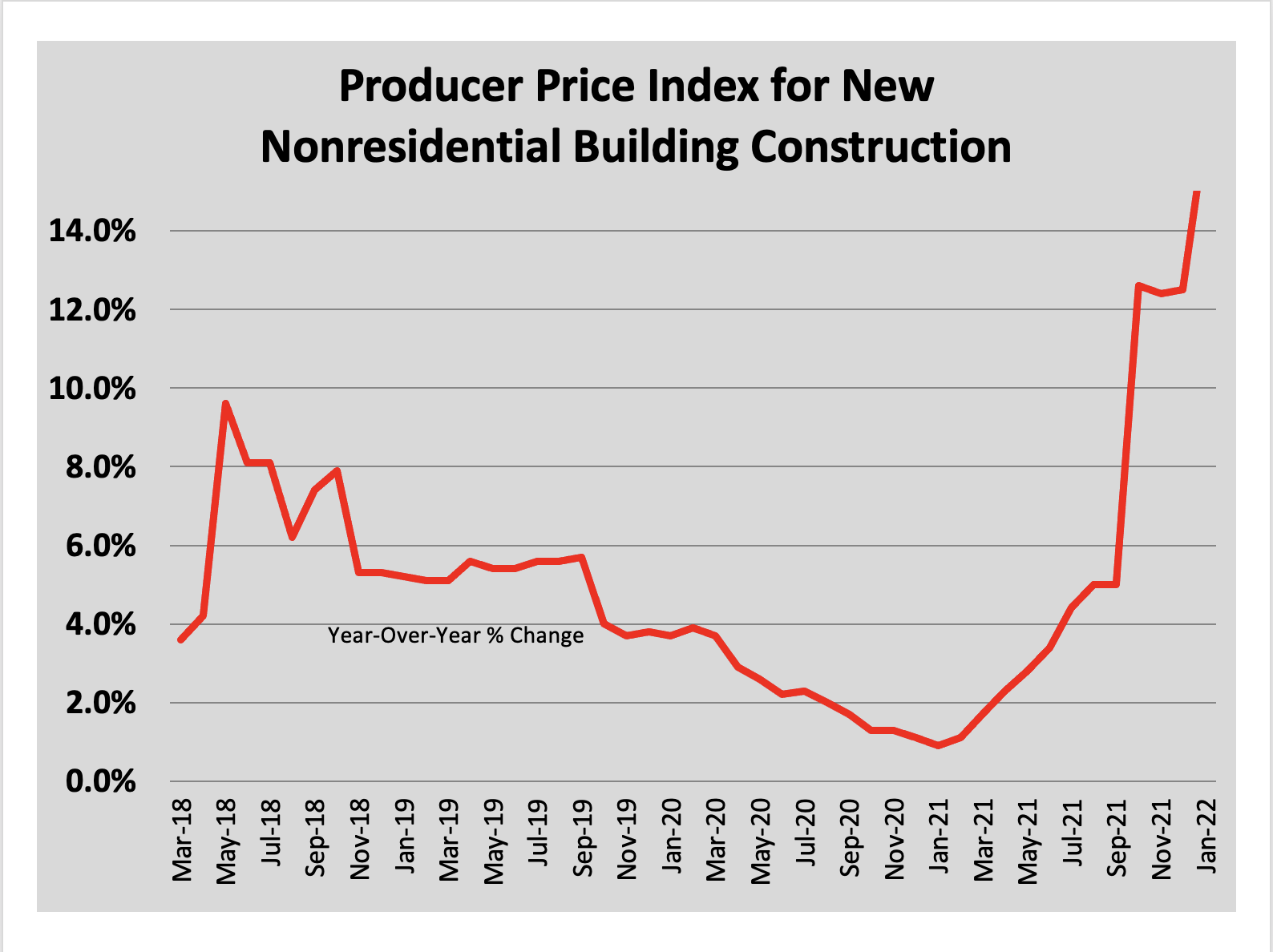

Supply chain problems are improving but are still forecasted to remain through the end of 2022, threatening to create performance issues for construction firms that did not account for delays. Inflation is the bigger threat, as the large pipeline of projects nearing the end of design have not been budgeted or bid in the current environment. Bid prices currently are running 15% to 50% over budget.

There are two characteristics to the inflation problem. Material price escalation is running about 15% year-over-year. Of greater impact each day is the risk premium applied by contractors. For the most part, bid prices in 2021 did not reflect the actual escalation. Contractors are better informed about escalation and, moreover, are pricing in the risk of unanticipated escalation for the balance of 2022 and 2023. Suppliers have assured that price increases will continue throughout 2022. Projects bidding now will see the impact of current estimates of escalation and the estimated risk of future escalation that will occur when materials are installed.

Demand from businesses, universities, hospitals, and consumers in Pittsburgh is stronger than before the pandemic. This bodes well for institutional, industrial, higher education, multi-family, single-family, and consumer-driven sectors. Only the office and government-funded sectors (excluding infrastructure) should underperform. How much construction is created by this elevated demand will be determined by how project owners/developers respond to the escalated pricing and extended lead times.

View all slides in Jeff’s presentation here, including a list of upcoming major projects in our region.

Jeff Burd, founder of the Tall Timber Group, is a content provider and consultant for the construction and real estate industries in Western PA. Tall Timber Group publishes BreakingGround and DevelopingPittsburgh magazines, and provides timely data on new home construction and contract awards for commercial/nonresidential construction

Jeff Burd, founder of the Tall Timber Group, is a content provider and consultant for the construction and real estate industries in Western PA. Tall Timber Group publishes BreakingGround and DevelopingPittsburgh magazines, and provides timely data on new home construction and contract awards for commercial/nonresidential construction